INTRODUCTION

general liability insurance: When you are running a business the factor of uncertainty is always there well just not only in the case of business but in any dimension of work that you proceed with it.

When running a business, protecting yourself from potential risks and liabilities is crucial. One way to do this is by obtaining general liability insurance. In this article, we will explore what public liability insurance is and why it is essential for businesses. We will also delve into the coverage, claims process, and benefits of this type of insurance.

WHAT IS GENERAL LIABILITY INSURANCE

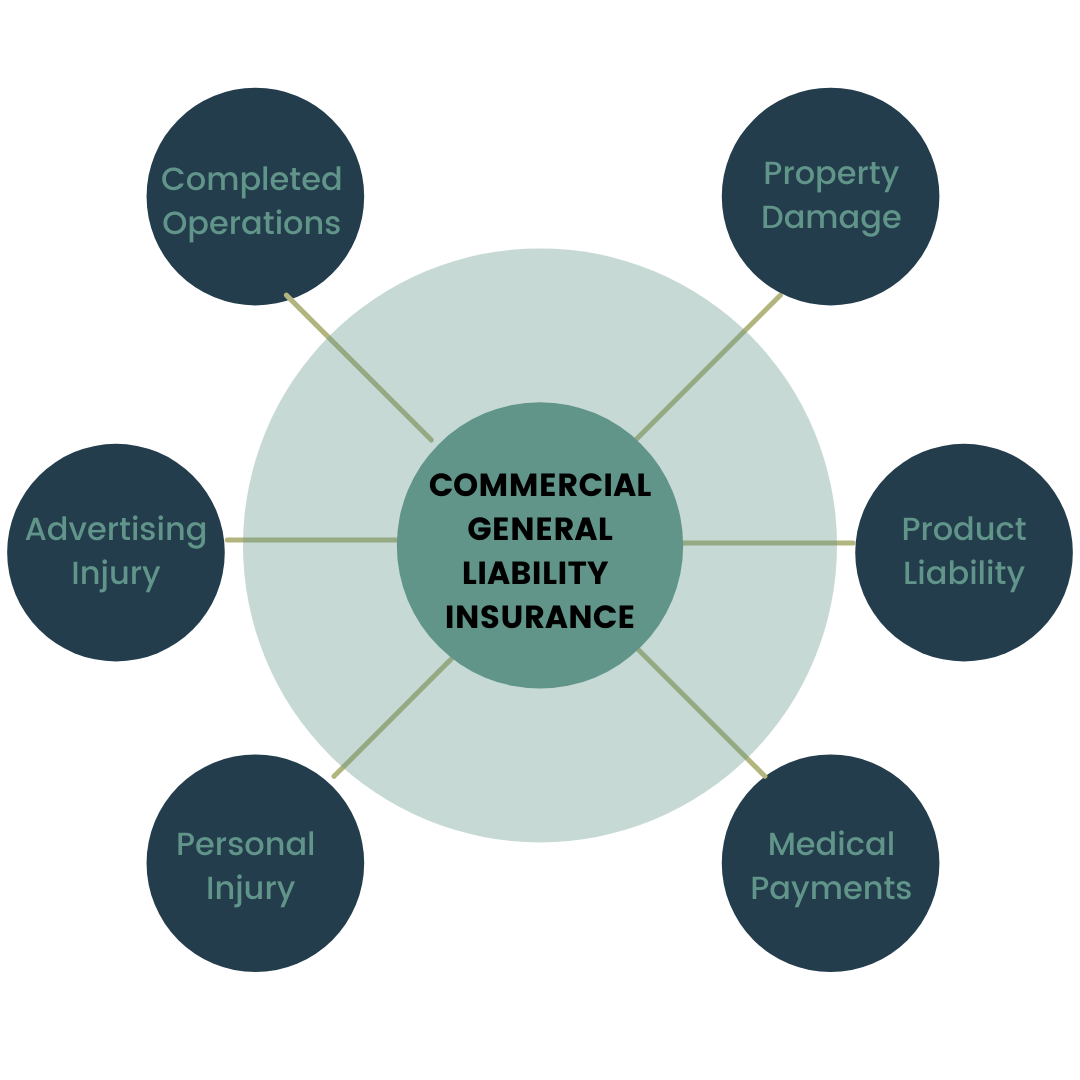

General liability insurance is a type of insurance policy that provides coverage for businesses against third-party claims of property damage, bodily injury, and personal injury. It is designed to protect businesses from financial loss in case of accidents, injuries, or lawsuits arising from their operations or premises.

COVERAGE PERIOD BY GENERAL LIABILITY INSURANCE

General liability insurance offers coverage for various scenarios, including:

BODILY INJURY: If a customer or visitor sustains bodily harm on your business premises, this insurance will cover medical expenses, legal fees, and any resulting settlements or judgments.

PROPERTY DAMAGE: Suppose your business causes damage to someone else’s property, such as accidentally breaking a client’s expensive equipment. In that case, general liability insurance will cover the costs of repair or replacement.

PERSONAL INJURY: This type of coverage protects your business against claims of defamation, libel, slander, or copyright infringement.

ADVERTISING INJURY: If your business’s advertising campaigns unintentionally cause harm to another company’s reputation, general liability insurance can provide coverage for resulting legal expenses.

THE CLAIMING PROCESS

When an incident occurs that may lead to a claim, it’s essential to follow the proper claims process. Here are the general steps involved:

Notify the Insurance Provider: As soon as an incident takes place, report it to your insurance provider. Provide them with all the necessary information, including the date, time, location, and details of the incident.

Gather Documentation: Collect any relevant documentation, such as photographs, witness statements, or police reports, to support your claim.

File the Claim: Submit a formal claim to your insurance provider, including all the necessary documentation. Be prepared to provide additional information or answer any questions they may have.

Claims Evaluation: The insurance company will review your claim and evaluate the coverage based on the policy terms and conditions.

Settlement or Denial: If your claim is approved, the insurance company will offer a settlement amount. If it’s denied, they will provide an explanation. You can negotiate the settlement or appeal the denial if necessary.

BENEFITS OF HAVING GENERAL LIABILITY INSURANCE

Having general liability insurance offers several benefits for businesses, including:

Financial Protection: General liability insurance protects your business from significant financial losses that could arise from expensive lawsuits or claims.

Peace of Mind: Knowing that your business is covered in case of accidents or lawsuits provides peace of mind, allowing you to focus on running your business.

Enhanced Credibility: Having general liability insurance demonstrates that your business is responsible and takes its obligations seriously, which can enhance your credibility with clients, partners, and stakeholders.

Customizable Coverage: General liability insurance policies can be customized to suit your business’s specific needs, allowing you to tailor coverage based on the risks associated with your industry.

CONCLUSION:

General liability insurance is a critical investment for any business, providing protection against potential risks, accidents, and lawsuits. It offers coverage for bodily injury, property damage, personal injury, and advertising injury. By understanding the claims process and the benefits of general liability insurance, you can make an informed decision to safeguard your business and its future.