Commodity trading is an exciting and potentially lucrative field that involves the buying and selling of raw materials or primary agricultural products. It is a global market where traders speculate on the price movements of commodities such as gold, oil, wheat, and coffee.

In this article, we will provide you with a comprehensive guide to commodity trading, including the basics, strategies, and risks involved.

If you want to learn more about the commodities market and investing segment just click here.

What are Commodities?

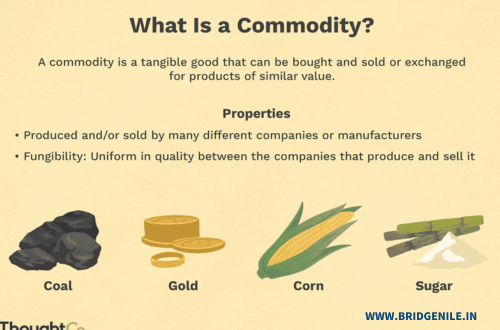

Commodities are tangible goods that can be bought and sold. They can be classified into four main categories:

- Agricultural commodities: These include products like wheat, corn, soybeans, coffee, and sugar.

- Energy commodities: This category includes crude oil, natural gas, and gasoline.

- Metal commodities: Gold, silver, copper, and platinum fall under this category.

- Livestock and meat commodities: These include live cattle, lean hogs, and pork bellies.

How Does Commodity Trading Work?

Commodity trading can be done through various methods, including futures contracts, options, and exchange-traded funds (ETFs).

Futures Contracts: Futures contracts are agreements to buy or sell a specific quantity of a commodity at a predetermined price and date in the future. These contracts are standardized and traded on exchanges.

Options: Options give traders the right, but not the obligation, to buy or sell a commodity at a specific price within a certain timeframe.

Exchange-Traded Funds (ETFs): ETFs are investment funds that trade on stock exchanges and aim to track the performance of a specific commodity or a basket of commodities.

Strategies in Commodity Trading

Commodity traders use various strategies to profit from price fluctuations:

- Trend Following: Traders follow the trend of a commodity’s price and enter positions accordingly.

- Spread Trading: Traders simultaneously buy and sell related contracts to profit from the price difference between them.

- Seasonal Trading: Traders analyze historical patterns and trade based on seasonal factors that affect commodity prices.

- News-Based Trading: Traders react to news events or economic indicators that can impact commodity prices.

Risks in Commodity Trading

Commodity trading involves risks that traders should be aware of:

- Price Volatility: Commodity prices can be highly volatile, influenced by factors such as supply and demand, geopolitical events, and weather conditions.

- Leverage: Trading on margin amplifies both profits and losses, increasing the risk of substantial financial losses.

- Market Manipulation: The commodity market can be susceptible to market manipulation by large players, affecting prices and creating artificial volatility.

It is important for commodity traders to have a solid understanding of these risks and to implement risk management strategies to protect their investments.

Conclusion

Commodity trading offers individuals the opportunity to participate in a global market and potentially profit from price movements in various commodities. However, it is crucial to acquire knowledge, develop effective trading strategies, and manage risks to succeed in this field. Whether you are a beginner or an experienced trader, always stay informed and adapt to changing market conditions.

Thanks so much for providing individuals with remarkably superb opportunity to read in detail from this blog. It is often so lovely and also jam-packed with fun for me and my office friends to visit your blog particularly thrice weekly to find out the new items you have. Not to mention, I’m actually contented concerning the spectacular tips and hints you give. Selected 1 facts in this post are truly the very best we’ve had.

Wohh exactly what I was searching for, thanks for putting up.

I likewise conceive hence, perfectly pent post! .

hello!,I love your writing so a lot! share we keep in touch more approximately your article on AOL? I require an expert on this area to solve my problem. May be that’s you! Looking ahead to look you.

I think this web site holds very fantastic indited content material content.