INCOME FUND: A STEADY INCOME OF FINANCIAL STABILITY

Income funds: income is the most important condition that one should give most importance to overtime because anything anywhere and whatever we do income becomes the most necessary work of everything we do, the more the person produces their income the more comfortable their life becomes where Asif at the same rate the expense chain goes up then there will be no difference how much ever income you produce.

In a world where financial markets can be turbulent and unpredictable, many investors seek a haven that offers a steady income stream. One such haven is the income fund. In this article, we’ll delve into the world of income funds, understand what they are, how they work, and why they have become popular for investors seeking financial stability.

WHAT IS INCOME FUND?

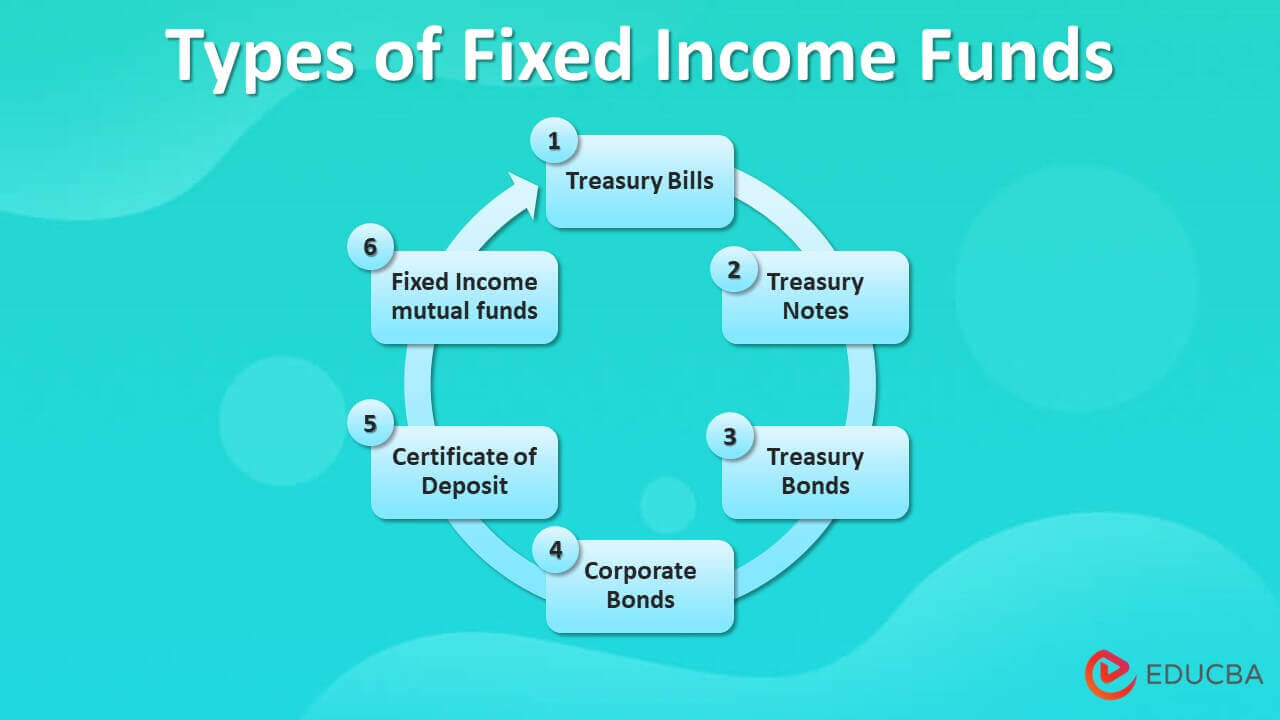

An income fund is a type of mutual fund or exchange-traded fund (ETF) that primarily focuses on generating regular income for its investors. These funds achieve this by investing in various income-generating assets such as bonds, dividend-paying stocks, and interest-bearing securities. The primary objective of an income fund is to provide a consistent source of income, making it an attractive option for those looking for financial security.

HOW DO INCOME FUNDS WORK?

Income funds work by pooling money from numerous investors and allocating it into a diversified portfolio of income-generating assets. Here’s how they operate-

ASSET DIVERSIFICATION

Income funds diversify their investments across various asset classes to reduce risk. These assets typically include bonds, preferred stocks, real estate investment trusts (REITs), and dividend-yielding equities. This diversification minimizes the impact of a single asset’s performance on the overall fund.

REGULAR INCOME DISTRIBUTION

Income funds generate income through the interest, dividends, and capital gains earned from their underlying assets. Investors receive periodic payouts from the fund, usually on a monthly or quarterly basis. The income generated can be a reliable source of cash flow for retirees or those looking to supplement their income.

WHO SHOULD INVEST IN INCOME FUNDS?

Income funds are well-suited for a variety of investors, including:

RETIREES –

Retirees often rely on income funds to support their living expenses. A steady income stream can help maintain financial stability during retirement.

RISK AVERSE INVESTORS-

For individuals who prioritize capital preservation and are risk-averse, income funds can be a safe investment choice. The diversified portfolio reduces the exposure to the volatility of individual assets.

THOSE SEEKING PASSIVE INCOME-

Investors looking for a source of passive income appreciate income funds. They don’t need to actively manage their investments, making it an attractive option for individuals with busy lifestyles.

ADVANTAGES AND CONSIDERATION

Income funds offer several advantages, but there are also some important considerations to keep in mind:

ADVANTAGES-

- Steady Income: Income funds provide a consistent stream of income, which can be a reliable source of cash flow.

- Diversification: They offer diversification across income-generating assets, reducing risk.

- Professional Management: Skilled fund managers oversee the portfolio, making investment decisions on behalf of investors.

CONSIDERATIONS-

- Risk of Market Fluctuations: Although income funds aim to minimize risk, they are not entirely immune to market fluctuations.

- Management Fees: Investors should be aware of the management fees associated with income funds, which can affect overall returns.

CONCLUSION

Income funds are a valuable investment option for those seeking a dependable source of income and financial stability. By understanding how they work, who should consider them, and their advantages and considerations, investors can make informed decisions about incorporating income funds into their investment portfolios. Whether you are a retiree looking for financial security or an individual seeking passive income, income funds offer a compelling solution to your investment needs.

Right now it sounds like BlogEngine is the best blogging platform available right now. (from what I’ve read) Is that what you’re using on your blog?

Thanks for the sensible critique. Me & my neighbor were just preparing to do some research on this. We got a grab a book from our area library but I think I learned more clear from this post. I’m very glad to see such fantastic info being shared freely out there.

I am very happy to read this. This is the kind of manual that needs to be given and not the accidental misinformation that is at the other blogs. Appreciate your sharing this best doc.

Thank you so much for providing individuals with an exceptionally special chance to check tips from this web site. It is usually very excellent and also packed with a good time for me personally and my office mates to search the blog not less than 3 times weekly to find out the newest items you will have. And of course, we are always motivated considering the incredible suggestions you serve. Selected 1 facts in this post are easily the best I’ve had.

Keep working ,fantastic job!

I real thankful to find this website on bing, just what I was looking for : D likewise bookmarked.

This web site is really a walk-through for all of the info you wanted about this and didn’t know who to ask. Glimpse here, and you’ll definitely discover it.