INTRODUCTION :

when we enter the world of finance and investing we generally see four sections of derivatives namely – FUTURE, OPTIONS, sWAPS, and FORWARDS, all of these derivatives have their ways of executing in the markets, the more we learn about them the better it becomes for us to understand the dynamics of the market.

UNDERSTANDING FUTURE CONTRACTS

future contracts: as we know a future contract is an agreement between two parties to sell or buy the future of any security according to the modes of exchange clearing houses, it generally works on a simple principle when the majority of traders or investors buy(long) the future then the price tends to go up and when majority of investor or trader plans to sell (short) the future then the prices tends to go down.

future contracts are generally applicable for stocks, indexes, currency, commodities, and interest rates, investors and traders generally use future contracts to observe the trend and conditions of the market to invest. in this blog, we will discuss the contracts of futures in detail.

SPECIFICATIONS OF FUTURES CONTRACT

CLOSING OUT POSITIONS

the vast majority of futures contracts do not lead to delivery. the reason is that most traders choose to close out their positions prior to the delivery period specified in the contract.

closing out a position means entering into the opposite trade to the original one now for example: a trader who bought a September index futures contract on June 5th can close out the position by selling one September futures contract on July 20 ( since the delivery date was on September end the trader didn’t waited onto it).

in each case, the traders total gain or loss is determined by the change in the futures price between june 5 and the day when contract is closed out.

THE CONTRACT SIZE: the contract size specifies the amount of asset that has to be delivered under one contract. this is an important decision for the exchange as well. if the contract size is too large many traders who wish to hedge relatively small exposure or who wish to take relatively small speculative positions will be unable to use the exchange.( during such times they use the derivative called swaps – which is used for macro level form , you can watch it on the movie “BIG SHORT”)

THE DELIVERY MONTHS: a futures contract is referred to by its delivery month. the change must specify its precise period since for different futures the dates are different. the delivery months may vary from contract to contract and are chosen by exchange to meet the needs of market participants.

PRICE LIMITS AND POSITION LIMITS OF CONTRACTS

for most contracts, daily price movement limit are specified by the exchange. if in a day the price moves down previous day close by an amount equal to the daily price limit, then the contract is said to be limit down. if it moves up by the limit it is said to be limit up.

a limit move is a move in either direction equal to the daily price limit. normally trading ceases for the day if the contract touches the limit up or limit down once, however in some instances the exchange has the authority to step up and change its limit range.

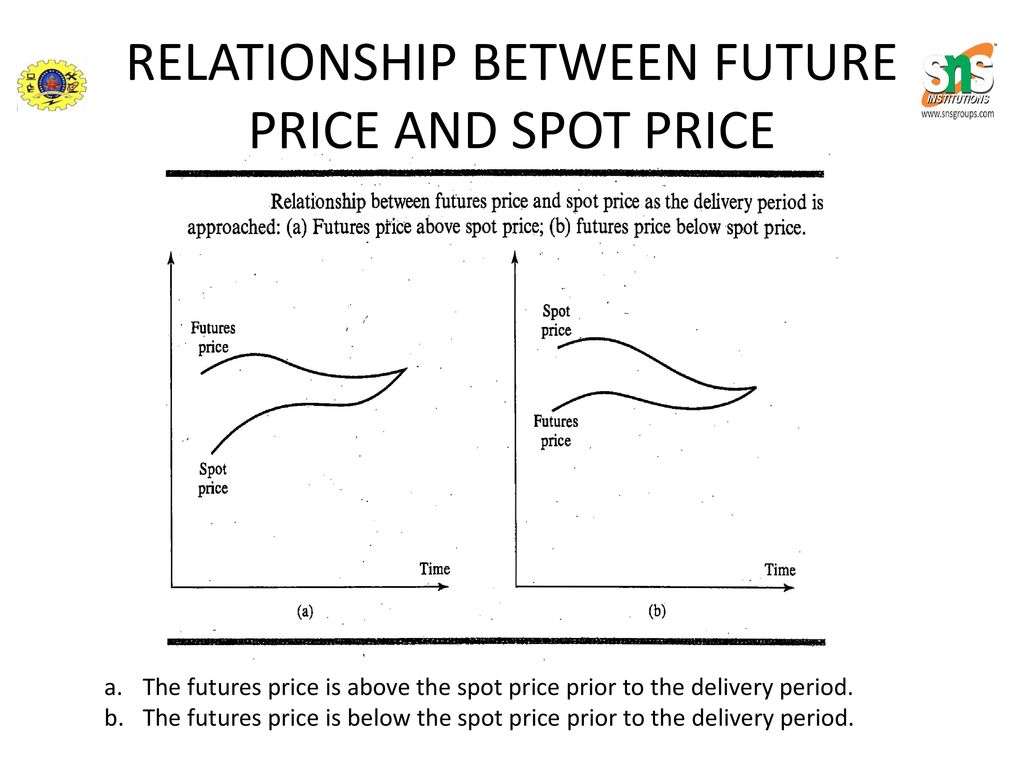

CONVERGENCE OF FUTURE PRICE TO SPOT PRICE

as the delivery period for a future contract approached, the future price converges( gets equal) to the spot price of the underlying asset.when the delivery period is reached the future price equals or very close to spot price.

- SELL ( SHORT) A FUTURE CONTRACT

- BUY ( LONG ) A FUTURE CONTACT

- MAKE DELIVERY OF A FUTURE CONTRACT

relationship between futures price and spot price as the delivery period is approached

CONCLUSION

this is the details about future contract wheather you trade in stock future or index future the process remains same , if you all like the process then please comment below so that we can upload the articles on other derivatives as well.

click here if you want to know more about inflation , delfaltion and stagflation .

[…] intentionally didn’t blog any article after my Future trading one, the reason being markets were too volatile and I was relatively busy managing my Investor’s […]

Your blog is a treasure trove of valuable insights and thought-provoking commentary. Your dedication to your craft is evident in every word you write. Keep up the fantastic work!

I just wanted to express my gratitude for the valuable insights you provide through your blog. Your expertise shines through in every word, and I’m grateful for the opportunity to learn from you.

thank you!

Great website. A lot of useful information here. I’m sending it to some pals ans additionally sharing in delicious. And obviously, thanks in your effort!

You got a very superb website, Glad I discovered it through yahoo.

Hello just wanted to give you a brief heads up and let you know a few of the images aren’t loading correctly. I’m not sure why but I think its a linking issue. I’ve tried it in two different internet browsers and both show the same results.

Hiya, I am really glad I’ve found this info. Today bloggers publish only about gossips and internet and this is really annoying. A good site with interesting content, that is what I need. Thank you for keeping this website, I’ll be visiting it. Do you do newsletters? Can not find it.

Exactly what I was searching for, appreciate it for putting up.

It is really a great and helpful piece of information. I am glad that you just shared this helpful information with us. Please keep us up to date like this. Thank you for sharing.

You have brought up a very good details , regards for the post.

There is obviously a bunch to realize about this. I think you made various nice points in features also.

I believe that is among the such a lot significant information for me. And i’m satisfied studying your article. But want to observation on some general things, The site style is perfect, the articles is actually excellent : D. Just right task, cheers

Hello! Someone in my Facebook group shared this website with us so I came to check it out. I’m definitely enjoying the information. I’m bookmarking and will be tweeting this to my followers! Outstanding blog and fantastic design.