INTRODUCTION

When you start investing or start your journey with investing and finance the only common topic you just come across is something called Taxation basically we call it tax.

so whenever and wherever we purchase product or services we pay taxes – why is it so? well, it’s the governance of every country and bylaws that we as a people of the country follow, A person who is born as a child until his death pays taxes no wonder whatsoever he or she is.

The word tax is derived from the Latin word “TAXO” which means- to judge the value of something, taxes are imposed by the government and are used for the service of their state, well thats what has been happening in India so far and in other countries as well.

The strength of any economy depends upon how good the tax system is because it’s the main basic earning source of any country’s economy.[ economy simply means transaction – so the more the transaction more the tax for governance.]

There are many different levels of tax systems especially in India basically the system says no matter what you do as a single person however you earn you have to pay a certain percentage of your earnings to your government.

HISTORY OF TAXATION IN INDIA –

Well, to come across there are basically two categories of taxes 1- DIRECT TAXES & 2-INDIRECT TAXES—– well Direct taxes are charged by the government from the entity without any third-party relevance & and Indirect taxes are charged from the government via third-party relevance.

Tax in Ancient India was generated by Manusmriti and Arthashastra and from there – which led to the rise of the JEZIA tax further abolished by Akbar and this gives rise to our latest tax systems, well even if you observe in America even though they have different tax systems the concept remains the same.

as we observe that for different countries the tax system and percentage of tax remain different- let’s take an example of sales tax here.

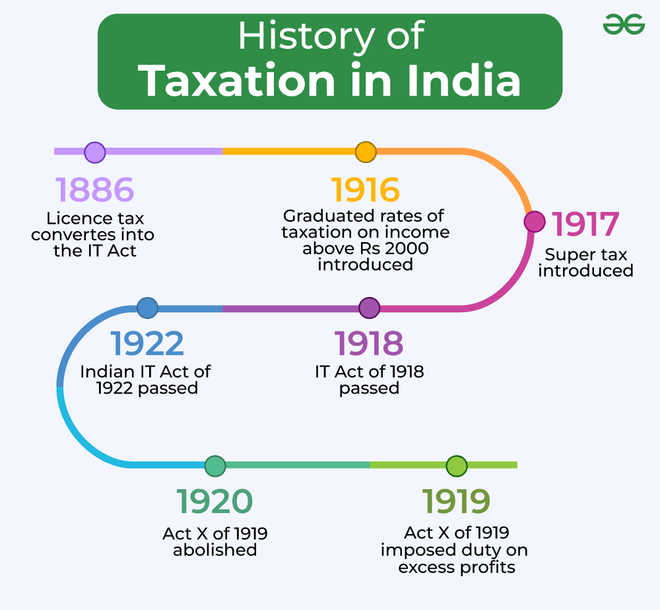

The Income Tax Act was passed in India in 1886, and after that, there were constant revisions until the Second World War after the independence it played a huge role in the growth of GDP in India.

EFFECTS OF TAXATION IN INDIA –

Currently, there are five board heads under which income tax is categorized

- INCOME FROM SALARY.

- INCOME FROM BUSINESS OR PROFESSION.

- INCOME FROM CAPITAL GAINS.

- INCOME FROM PROPERTY.

- INCOME FROM OTHER SOURCES.

well to keep it clear I would like to say that income tax and property tax fall under direct taxes whereas gift, wealth, sales, VAT, customs duty, and excise duty ( and many of these are replaced by GST in the year 2017)

India currently has a tier setup for taxation, the central government and the state government can impose tax. the state government can distribute the function of accumulating tax from gram panchayat and municipal corporations.

Since India, we have a bit more complex tax system as compared to any other countries as a result we basically observe the high demand for income tax consultants, GST consultants, auditors, and many other professions.

There are many types and categories of direct taxation underselling any normal security be it stocks, bonds, real estate, mutual funds, trading, fixed deposit, and many other securities, which we will discuss later in our blogs.

CONCLUSION-

Well in any field no matter what it is you as an individual are bound to pay taxes- be it even in your real estate if you don’t pay your property tax for your land or your house it just doesn’t belong to you, it basically belongs to the government if you don’t believe then trying not paying taxes and see whom does it being to.

Today I am writing this blog as of 24th July 2024, and the inspiration I got to write this article is after our Union budget declaration in INDIA and we observed a hiked in securities tax rates.

Very nice post and right to the point. I am not sure if this is really the best place to ask but do you guys have any thoughts on where to employ some professional writers? Thank you 🙂

BWER delivers robust, precision-engineered weighbridges to businesses across Iraq, combining state-of-the-art technology with local expertise to support infrastructure and logistics growth.

Thank you!

An impressive share, I just given this onto a colleague who was doing a little analysis on this. And he in fact bought me breakfast because I found it for him.. smile. So let me reword that: Thnx for the treat! But yeah Thnkx for spending the time to discuss this, I feel strongly about it and love reading more on this topic. If possible, as you become expertise, would you mind updating your blog with more details? It is highly helpful for me. Big thumb up for this blog post!

The heart of your writing whilst appearing reasonable originally, did not settle very well with me after some time. Somewhere within the sentences you were able to make me a believer unfortunately only for a while. I however have got a problem with your jumps in assumptions and one might do well to fill in those gaps. If you actually can accomplish that, I could undoubtedly be impressed.

I truly appreciate this post. I?¦ve been looking everywhere for this! Thank goodness I found it on Bing. You’ve made my day! Thank you again

Excellent beat ! I wish to apprentice at the same time as you amend your site, how could i subscribe for a blog site? The account aided me a appropriate deal. I were tiny bit acquainted of this your broadcast offered brilliant clear idea

This really answered my problem, thank you!

Valuable info. Lucky me I found your site by accident, and I am shocked why this accident didn’t happened earlier! I bookmarked it.