INTRODUCTION

standing today well no one can predict which direction is the market going to swing if we observe the predictions then we see that the market has just failed to impress the majority, well it’s not the first time it has been done earlier, and it will continue to be the same forever.

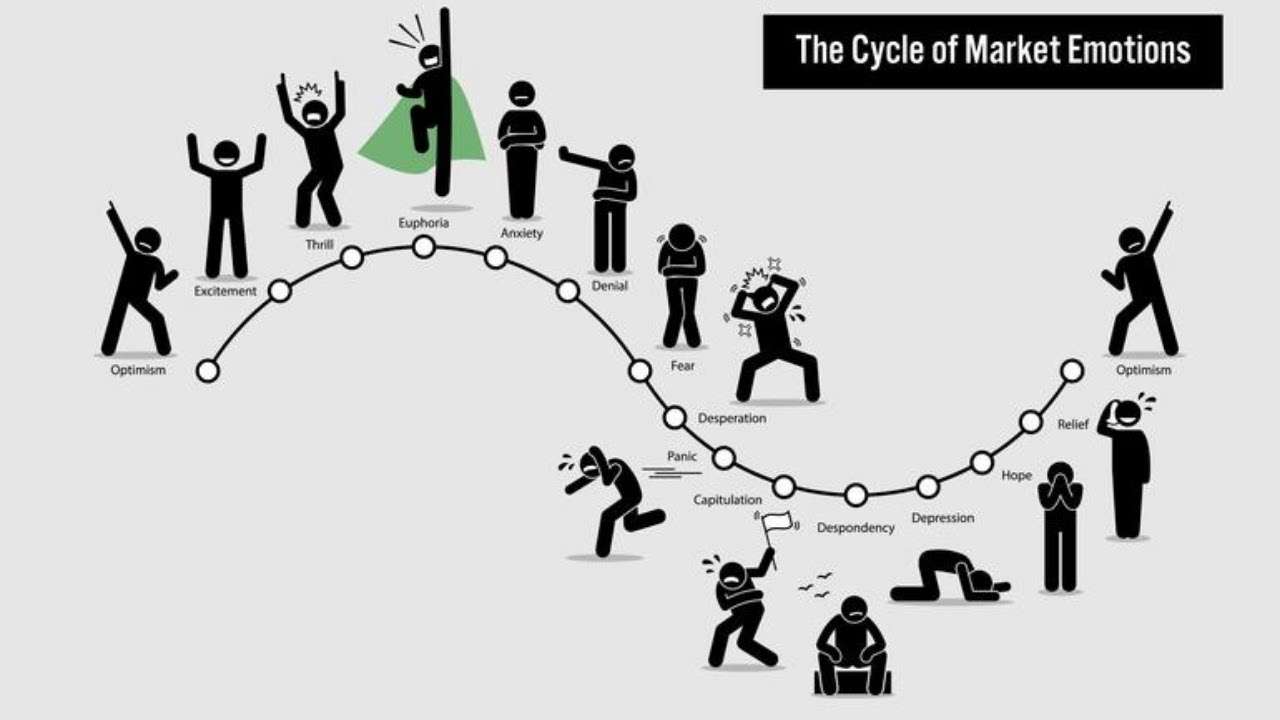

The swings observed in the market just not in 2024 or any year are due to the phenomena of euphorism and depression.

THE INVESTING OSCILLATION –

In the field of investing oscillation is the only dependable feature of the investment world, since it oscillates from euphoria and depression.

there is a common saying that goes on in the market that the market swings between two emotions “GREED & FEAR” ” In other words people feel positive and expect good things to happen thats when greed takes place and keeps pushing the price upwards( since due to the greed factor everyone makes more investment) and makes the swing towards it extreme.

But at other times the expectations turn less good and fear takes over, rather than getting enthusiastic about making money they just get fear of losing money. this prevents them from buying further and lets the market participants shrink from buying which enables them to sell and push the prices down.

that is when people come into fear mode and bring the bear market down and the prices just keep shooting down vigorously and every single small-phased investor is willing to sell and make the downward swing to its extreme.

remembering such swings which are caused by fear and greed tend to move the price of stocks or assets toward their extreme which is rarely possible for any random person to predict early on.

THE CYCLE OF MARKETS-

The first phase of the market cycle always starts with the story of lower interest rates( cuts in rEPO rates) so with the lower interest rates the stock market starts pushing upwards towards greed and gives rise to the upward cycle.

now in phase two – once the interest rates have been lowered, this factor will give rise to a new process called “inflation” As a result the markets will start sloping down.

phase three starts when the market starts turning down but due to lower interest rates it gets resisted from the lower side and generates a sluggish economy (an economy in which the Country’s GDP and other factors move very slowly across the globe) and that will try to get the market move upwards via printing money or via raising taxes.

which brings us to phase four, which I call the momentum phase, after printing a lot more money the market moves into an overheated economy and to control all the factors the central bank (which in India is the RBI ) prints money and reimposes the higher interest rates, which lowers the rate of inflation and tries to stable out the economy.

and by doing so the market shows high volatility and hits higher highs until the next turnover or until the beginning of phase one again, and this is how the cyclical position of the market repeats again and again.

CONCLUSION

so if you are an investor or want to understand or predict the markets then my single recommendation is that never try to predict the markets because there is a higher probability that the market rarely goes wrong and your analysis or prediction can be massively wrong if you try to predict the markets.

It definitely takes huge courage for any investor to say that the market is wrong, and also coming up with all these market cycles you still can be unknown about the circumstances, the reason being no one knows how much extreme the swings will be at their maximum.

Great Article bro thanks, situs slot gacor maxwin

Great Article bro, bandar togel resmi

KingKoi88 anjing kau

thank you!

[…] the cycles get formed and what is the next certain thing to come. which you can read here “What is the next movement in the market“. the reason for writing this blog is to explain the cause of uncertainties in the global […]

Ive read several just right stuff here Certainly price bookmarking for revisiting I wonder how a lot effort you place to create this kind of great informative website

Thank you, I have just been looking for info about this topic for ages and yours is the greatest I’ve discovered so far. But, what about the bottom line? Are you sure about the source?

Yes sure!

There is visibly a bunch to realize about this. I consider you made various good points in features also.

Hello there, I found your blog by means of Google while searching for a comparable subject, your website got here up, it seems great. I have bookmarked it in my google bookmarks.

I like this blog so much, bookmarked. “I don’t care what is written about me so long as it isn’t true.” by Dorothy Parker.

Hey There. I found your blog using msn. This is a really well written article. I will make sure to bookmark it and come back to read more of your useful info. Thanks for the post. I will definitely comeback.

I think other web-site proprietors should take this site as an model, very clean and fantastic user genial style and design, as well as the content. You’re an expert in this topic!

What¦s Going down i am new to this, I stumbled upon this I have found It absolutely helpful and it has aided me out loads. I am hoping to give a contribution & help different customers like its helped me. Great job.

You made some good points there. I looked on the internet for the issue and found most people will consent with your blog.

But a smiling visitant here to share the love (:, btw outstanding pattern.

I’ve been browsing on-line greater than 3 hours lately, but I by no means found any attention-grabbing article like yours. It is lovely value sufficient for me. In my view, if all webmasters and bloggers made good content as you did, the web will likely be much more helpful than ever before. “Perfection of moral virtue does not wholly take away the passions, but regulates them.” by Saint Thomas Aquinas.