INTRODUCTION

As we know the rule is to ” SAVE AND INVEST THE DIFFERENCE” Our target is to save but at the same time to invest as much as possible, now coming to the point of investment we generally make certain errors on how and where we should evaluate and put our money on, many advisors, SEBI registered and influencers will give you their own opinion but the main question still remains is where should you invest in these uncertain market conditions?

well in my last blog, I have explained how the cycles get formed and what is the next certain thing to come. which you can read here “What is the next movement in the market“. the reason for writing this blog is to explain the cause of uncertainties in the global markets and in our native indexes.

In this article, I have directed between the functions and effects of REPO rates and the position in the market cycle where we are actually standing, well if you don’t know what REPO rates are then let me explain it briefly- and if you want to know in-depth details than you can click here.

well, we know that any country has three governments basically the Central bank, the central government, and the military government. For India, the central bank is the RBI and for the US it’s the FED and so is there for different nations. these governments do perform a transaction among themselves or you can call it a business.

this is how the business goes, first The RBI ( which is the central bank) prints money and lends it to the central government and the central government lends it to the commercial banks, the RBI gives the printed money to the central government at a rate of suppose 6.50% which is called the repo rate( as on 19- September 2024) and the central government give it to the commercial bank at an interest rate of something around 8.50-9.15% ( this is the rate that the people generally gets from banks ).

REPO rate means basically repurchasing options for the central government from the RBI at a certain rate and these rates can be cut off or hiked based on the situation thats under demand.

THE REPO RATES FUNCTION ESPECIALLY CUTS AND HIKES

Let’s observe how the REPO rate cuts and hikes have been observed in INDIA in the last 7-8 years! well, you can ask why are we choosing the period for 2018-2024. why not any earlier phase or any other decades?

this is because The hikes and cuts in REPO rates have been the most in these 7-8 years if you observe the NSE returns from 2000 -2024, you will understand what are the imprudent factors that impacted the market returns.

now if we just observe this chart we will be able to conclude that from the year 2019-2022, There were REPO rate cuts from 6.50-4%, so the RBI has drawn down the rates at 2.5% and you can observe that the NSE ( national stock index) rose around 51.04% in three years by generating 17% CAGR. (whenever there are cuts in repo rate there is an upward movement in the stock prices and the bond value increases).

Yes, there are multiple reasons why the RBI Cut down the rEPO rates ( starting from COVID), but again if you move from 2022-2023 we have seen a massive hike in REPO rates from 4-6.50%, and to date, it has remained unchanged.

Due to the significant hike in REPO rates in the last two years, NSE generated 23.74% ( approximately 11.87% a year) which signifies that due to a higher level of inflation, the RBI had to control the system and hiked the REPO rates which also impacted the CAGR. ( whenever there is a hike in the REPO rate then the maker returns tend to go down and also the bond value decreases.)

We conclude that the asset prices and Interest rates are inversely proportional and the interest rates ( REPO rates) are also inversely proportional, so the simple way to understand it is whenever there is a cut in the REPO rate then the only thing you should do is purchase bonds and diversify the portfolio that gives you the security against the uncertainty of the market.

so now I do expect every single reader to understand that when the news and social media talk about hikes or cuts in interest rates they are basically talking about REPO rates.

Now let us understand where are we standing in the cycle and what impact the change in interest rates will have on us.

WHERE DO WE STAND IN THE CYCLE-

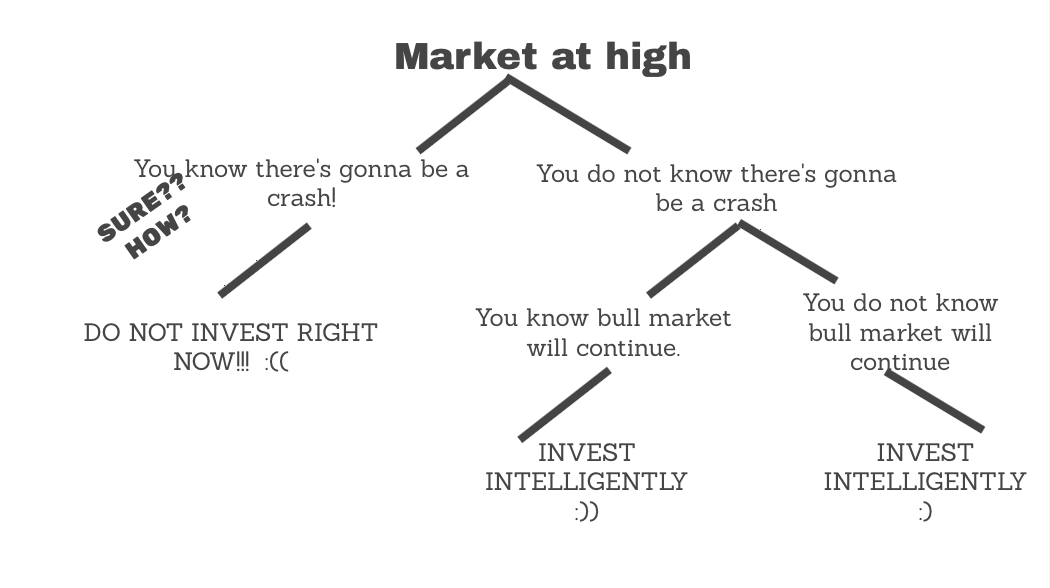

to understand where we stand in the market cycle we can’t go through any random indicator, any random news, some analyst recommendation, or Even if a great economist says something! So now the question arises how do we understand where are we standing in the market cycle?

It’s never possible for the market to indicate the next movement, but it is possible if we generally observe The psychology of the market participants thats where you understand how the market will behave actually and what’s going to be the next big movement, As sir John Templeton says “TO BUY WHEN OTHERS ARE DESPONDENTLY SELLING AND WHEN OTHERS ARE GREEDILY BUYING REQUIRES THE GREATEST FORTITUDE AND PAYS THE GREATEST REWARD”

So if you just understand what is the behaviour of the majority of participants in the markets you are sure to understand what is going to happen next because thats what it is -you just need to have the opposite psychology from the majority of investors. Now the next question that comes up is how to understand what is the psychology of the majority of investors.

this is something that Warren Buffet says- When others are euphoric, we should be terrified and when others are terrified we should be aggressive, he also further explains that It’s not what you buy that determines your results, it’s what you pay for it.

| ECONOMY | VIBRANT ( BULLISH) | SLUGGISH( BEARISH) |

| OUTLOOK | positive | negative |

| BEHAVIOUR OF LENDER’S | eager to lend | resist to lend |

| CAPITAL MARKETS | loose the monetary system | tighten the monetary system |

| CAPITAL | plentiful | rare |

| TERMS AND CONDITIONS | easy | restrictive |

| INTEREST RATES | low | high |

| YIELD SPREADS | narrow | wide |

| lose the monetary system | optimistic | pessimistic |

| ASSET OWNERS | happy to hold | rushing for the exits |

| SELLERS | few | many |

| MARKETS | crowded | PSYCHOLOGY OF INVESTORS |

| FUNDS: | hard to gain entry | open to anyone |

| new ones daily | only the best can raise money | |

| RECENT PERFORMANCE | STRONG | WEAK |

| ASSET PRICES | high | low |

| PROSPECTIVE RETURNS | low | high |

| RISK | high | low |

| THE MAJORITY OF MISTAKES | Buying too much | Buying too little |

| Taking too much risk | Taking too little risk |

now I think it’s easier to understand which cycle we are in and what would be the best next step we should take to win the game of investing, if you can just follow and execute with fortitude you are definitely to become wealthy. well, this is not the first time I have explained this many great investors have explained it before as well. Again what matters is the fortitude to go against the majority.

If you want to read more about the bull market and how it works you can read it here. written by Howard Marks.

IMPORTANT ASPECTS TO KEEP IN MIND ABOUT CYCLE-

everyone sees what happens each day, as reported in the media but how many people make an effort to understand what those everyday events say about the psyches of market participants, the investment climate, and thus what should be done in response?

so look around and ask yourself are investors optimistic or pessimistic? do the media talk about whether the market is piled into or avoided? Are securities offerings and fund openings being treated as opportunities to get rich or possible pitfalls? are price/ earning ratios high or low in the context of history, and are yield spread tight or generous?

all these factors are very crucial, yet after observing all these you can’t proceed toward forecasting. we can make excellent investment decisions on the basis of present observation, with no need to make guesses about the future.

at any random time, lots of things are happening in this world, including the economy, and the investment environment. no one can study, praise, and understand and put them all under-investment decisions. at any rate, different events occur. in each cycle and in different sequences.

when investors are flying high and making money it becomes really hard for them to get constrained by valued norms, because the explanation usually begins with “it’s different this time“. watch out for this ominous sign of willing suspension of disbelief. Always remember that Risk is involved and there is something that you just don’t know ( the unpredictable). there can be no other person who can explain this phase than HOWARD MARKS.

WHAT’S LIKELY ABOUT TO HAPPEN?

as we know the market cycle responds from one arbitrary condition to another, which makes it almost impossible to predict what’s gonna happen exactly, but this is also true if you are there in an uptrend market cycle, which just tends to move up and up which make the euphoric condition than you might just observe these symptoms in the markets.

- good economic news

- favorable articles and movies.

- carefree risk- oblivious behavior on the part of investors.

- unusually strong investment results.

- extremely high market valuation relative to history.

- believing that this upward trending cycle will never stop.

well, this is not just once but if you observe the history you will get the conclusion that starting from 1999( dot com crash) which was the reason for the 2008 ( mortgage crisis) and due to excessive amounts of volatility and money printing in the recent years one can have an idea that in which direction is the market heading. you can read here that after 2008 what exactly happened and due to those factors what is the probability of things that are about to happen?

for example, if you just observe history the interest rates got cut when the economy was sluggish or needed support ( more purchasing power and higher employment) but in 2024 the month of September we observed that the FED cut REPO rates even when the markets were at all-time high, now this is something not familiar with previous cycles.

now from here on it has the probability to move further upward due to rate cuts as this seems obvious according to the FED the markets were in recession or sluggish which makes it sideways or due to high printing of money this would cause over devaluation and can bring the markets down. well, these are all overestimates and probabilities.

definitely, the easiest way to move in these types of cycles is to diversify and move accordingly but this is the same thing that I am trying To convey in almost all of my blogs, and I still firmly believe that if you have a diversified portfolio of more than 10 uncorrelated investments you do have a potential to beat ay particular uncertainty in the markets.

if you just observe in detail about the 2008 market crash you would see some points which are familiar to current scenarios.

- everyone saw a huge decrease in risk aversion and thus disappearance of skepticism.

- the thought of acceptance that homes and mortgages will continue to be stable forever.

- having excessive faith in new tools like financial engineering and risk management.

- negligence of the impact of blindness on improper incentives.

where if we just conclude these historic past movements we are observing similar properties which rightly have the tendency to proceed further, in my opinion, I would say that it is the cycle that repeats again and again for the same psychological causes of investors but just in a different story ( where the effect remains the same).

George Soros’s THEORY OF REFLEXIVITY STATES – “ in situations that have thinking participants, distorted views can influence the situation to which they relate because false views lead to inappropriate actions”

CONCLUSION

So by answering the question that where should you invest in these uncertain conditions – I would like to summarize that always look for which phase of the cycle you are in (if you want returns for your investors), if you are just a regular investor than just don’t worry about anything whenever you see a bargain price of your stocks just invest with a margin of safety(just think of returns in long term).

Ищете надежные электротехнические решения? [url=https://tex38.ru/]ТехЭлектроснаб[/url] предлагает огромный выбор кабелей и оборудования. Мы обеспечиваем качественную продукцию с быстрой доставкой по всей России.

Your blog is a beacon of light in the often murky waters of online content. Your thoughtful analysis and insightful commentary never fail to leave a lasting impression. Keep up the amazing work!

Thank you too much!

“Mind = blown! 🌟 This is exactly the comprehensive breakdown I needed. Your expertise shines through in every paragraph. Thanks for sharing such well-researched content.”

“What a gem I’ve discovered! The thoroughness of your research combined with your engaging writing style makes this post exceptional. You’ve earned a new regular reader!”

Thank you so much!

Thank you!

[…] IMPACT AND CONCLUSION TO UPCOMING VIEW OF THE ECONOMY […]

Revolutionize your weighing needs with BWER, Iraq’s top provider of weighbridge systems, featuring unparalleled accuracy, durability, and expert installation services.

Just wanna remark on few general things, The website style is perfect, the subject matter is rattling excellent : D.

Thank you !

[…] 2008 meltdown, all banks printed a lot more money ( which they call cuts in repo rate which you can see here), but as normal thinking, we tend to think that why does Fed rate cuts impact our country or across […]

I and also my pals have been taking note of the good helpful hints on the website then unexpectedly got an awful feeling I had not thanked the site owner for those tips. The young boys had been as a consequence excited to read them and already have certainly been tapping into these things. Thank you for truly being so helpful and then for going for variety of quality resources most people are really wanting to be aware of. My very own honest apologies for not expressing appreciation to you earlier.

Hello.This post was really fascinating, particularly since I was looking for thoughts on this topic last Monday.

[…] Earlier Unfortunately it just happened now.What am I talking about? well if you have read my blog where-should-we-invest-in-these-markets-in-2024 I did Talk about the upcoming macroeconomic conditions for India as it was supposed to happen by […]

Your style is so unique compared to many other people. Thank you for publishing when you have the opportunity,Guess I will just make this bookmarked.2

What’s Happening i’m new to this, I stumbled upon this I have discovered It absolutely useful and it has aided me out loads. I am hoping to contribute & aid different customers like its helped me. Good job.

I like this web blog so much, bookmarked. “Nostalgia isn’t what it used to be.” by Peter De Vries.

You got a very wonderful website, Sword lily I discovered it through yahoo.

Its like you read my mind! You seem to know so much about this, like you wrote the book in it or something. I think that you can do with a few pics to drive the message home a little bit, but instead of that, this is magnificent blog. An excellent read. I will definitely be back.

Keeping pace with regulatory changes can be challenging, but Iraq Business News highlights new laws and policies that impact business operations, ensuring you remain compliant and competitive